Financial services are undergoing a major shift. The pressure to innovate is high, but the regulatory environment is unforgiving. FinTech is redefining banking with cloud-native platforms, mobile-first design, real-time data streaming, and embedded AI. Yet they must do all this while maintaining full control, traceability, and compliance. This blog post explores how regulated FinTechs are succeeding with event-driven architecture and real-time data streaming using technologies like Apache Kafka and Flink in the age of AI. It highlights modern patterns like Retrieval-Augmented Generation (RAG), Agentic AI, and domain-driven design with data products. One pioneering example—Alpian, Switzerland’s first fully digital private bank—shows how it’s done.

Join the data streaming community and stay informed about new blog posts by subscribing to my newsletter and follow me on LinkedIn or X (former Twitter) to stay in touch. And make sure to download my free book about data streaming use cases, including various examples in financial services and AI-related topics like fraud prevention and generative AI for customer service.

Regulated FinTech: Balancing Compliance, Security, Innovation and AI in Modern Banking

Financial services is one of the most heavily regulated industries worldwide. FinTech companies must operate under strict rules related to data security, privacy, auditability, and risk management. Regulatory bodies demand transparency, encryption, access control, and full accountability across all processes.

FinTech is expected to deliver modern, intuitive, and real-time digital experiences. This creates a challenging dynamic: drive innovation while meeting stringent legal and operational standards.

Success in this space requires more than just technical capabilities. It demands built-in compliance from day one. Governance, data protection, explainability, and monitoring must be integrated directly into the design of products, systems, and teams. Compliance is NOT an afterthought—it must be a core pillar of architecture and operations.

Data Streaming with Apache Kafka and Flink in Financial Services and FinTech

Most traditional financial systems still rely on batch processing. Data is collected and processed in bulk, often with delays of hours or even days. This limits real-time decision-making and slows down customer interactions, fraud detection, and operational efficiency.

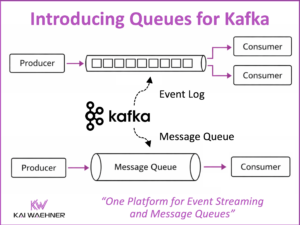

In contrast, modern FinTech and crypto-native companies are moving toward data streaming architectures. These systems treat data as a continuous flow of events—transactions, account changes, market signals, or compliance alerts—processed in real time. FinTech builds Kappa instead of Lambda architectures.

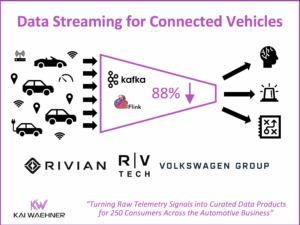

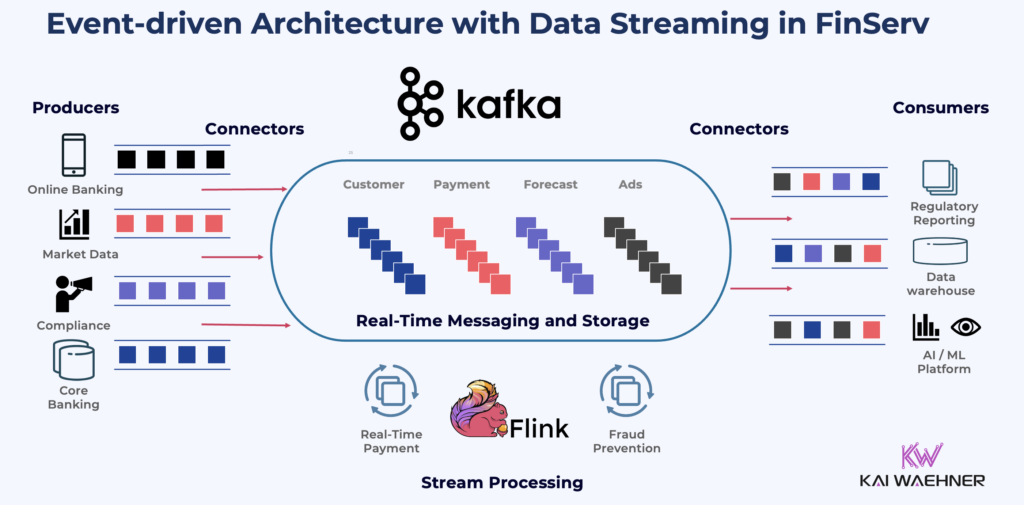

Technologies like Apache Kafka and Apache Flink have become central components in this evolution. Kafka provides a scalable, fault-tolerant pipeline to ingest, store, and distribute real-time events. Flink adds stateful stream processing for use cases such as fraud detection, transaction monitoring, or market trend analysis.

FinTech players across payments, lending, trading and crypto now rely on data streaming to stay competitive. For example:

- Robinhood uses real-time feeds to update portfolios and execute trades instantly.

- Stripe processes millions of payment events per second for online merchants.

- Coinbase handles continuous crypto wallet transactions, price updates, and compliance signals across global markets.

Data streaming empowers these companies to offer real-time personalization, reduce risk exposure, and maintain operational agility. It also supports integration of AI/ML models and analytics with low-latency access to fresh contextual data.

In regulated environments, data streaming can also enhance compliance—by embedding monitoring, traceability, and governance directly into data pipelines. As the financial industry continues to digitize, streaming-first architectures are becoming the new standard for building scalable, intelligent financial systems.

Alpian Bank: Cloud-Only Regulated Digital Native FinTech in Switzerland

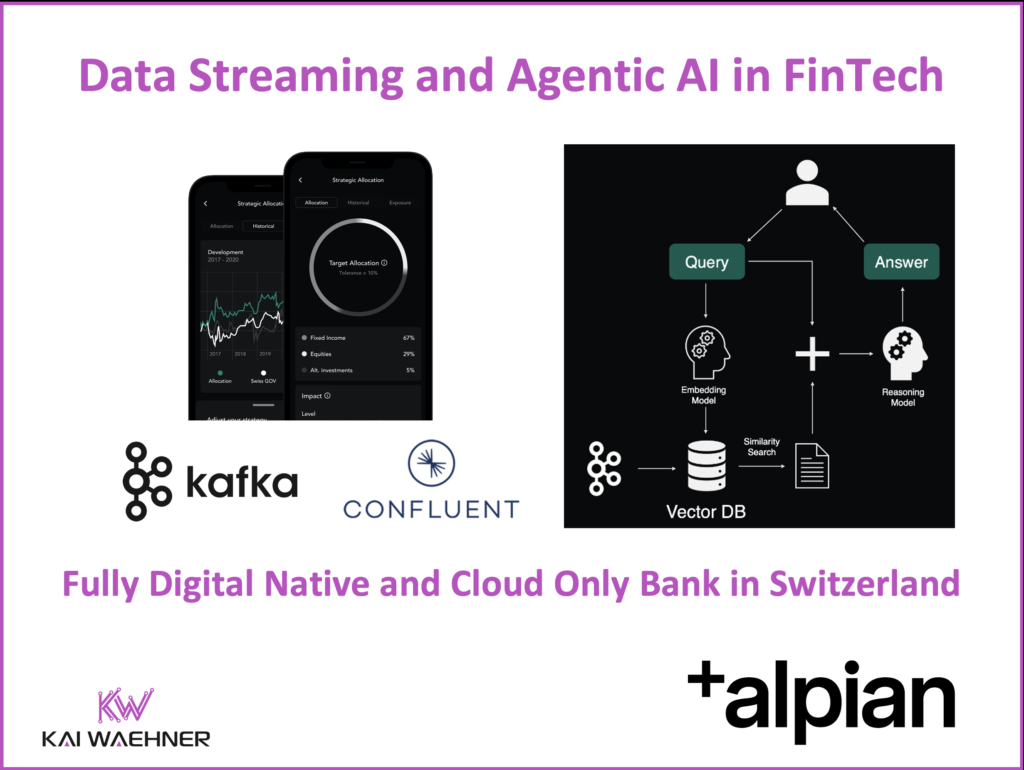

Alpian is a fully digital bank based in Switzerland, targeting affluent clients. It is a standout example: As Switzerland’s first fully licensed digital private bank, Alpian operates under the supervision of FINMA (the Swiss Financial Market Supervisory Authority).

Alpian offers banking with full regulatory oversight but built entirely with a digital-native mindset. Every decision—from encryption to access controls to explainability in AI—meets regulatory expectations. It is a cloud-only institution, operating entirely without physical data centers. All customer interactions take place through mobile applications, making it mobile-only by design. As a digital-native bank, it was built from the ground up using modern technology principles and architectural best practices.

Alpian offers the following services:

- Multi-currency accounts with commission-free exchange in CHF, EUR, USD, GBP

- Wealth management with three curated investment plans

- Cards and payments with global reach

- Low Foreign Exchange (FX) fees—up to 7x lower than traditional banks

- Live advisory via chat and video

The bank was built for flexibility, personalization, and global usage—without compromising security or compliance. Alpian is also open to partnership models, integrating financial services into broader platforms.

IT Enterprise Architecture at Alpian Bank

Alpian’s architecture is event-driven by design. Luca Magnoni from Alpian explored the FinTech’s use cases, architectures and AI strategy around Agents and RAG at Current 2025 in London. Apache Kafka is the central nervous system connecting all systems through events.

The enterprise architecture uses the following principles to enable data-driven and AI-powered banking:

- Microservices that publish and consume events asynchronously

- Domain events as single sources of truth

- CQRS pattern to separate reads from writes

- Decoupled services for maximum scalability and maintainability

This event-driven architecture enables the foundation for Agentic AI and RAG: Agility, observability, and resiliency. It also embeds governance and encryption from the start, including schema-driven development, strict access controls and Confluent’s Field-Level Encryption (CSFLE).

The architecture is shift-left by principle. Each development team owns its domain, including data modeling, quality assurance, and compliance responsibilities.

Data at the Center: Event-Driven Architecture and Domain-Driven Data Products at FinTech Alpian

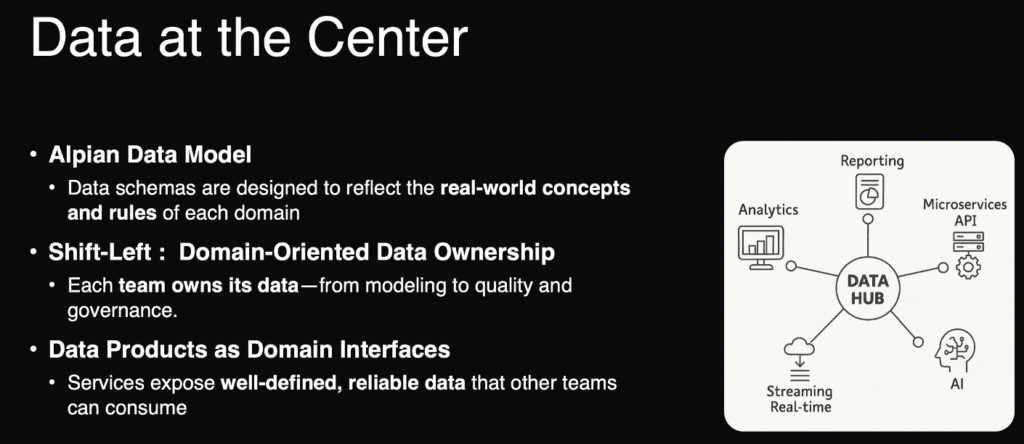

At Alpian, data is a first-class citizen. The data model is built around real-world financial concepts and domain rules. Teams are responsible for their data from end to end—design, ownership, access, and quality.

Key practices include:

- Schema-driven development using Protobuf and Confluent Schema Registry

- Domain-oriented ownership, where each team exposes data products

- A shared data hub for operational microservices, analytics, and AI

- Shift-left approach to identify sensitive fields early and enforce encryption

This strategy reduces friction between teams, ensures data integrity, and supports real-time and historical data access—all in compliance with regulatory controls.

Agentic AI, RAG and Data Streaming

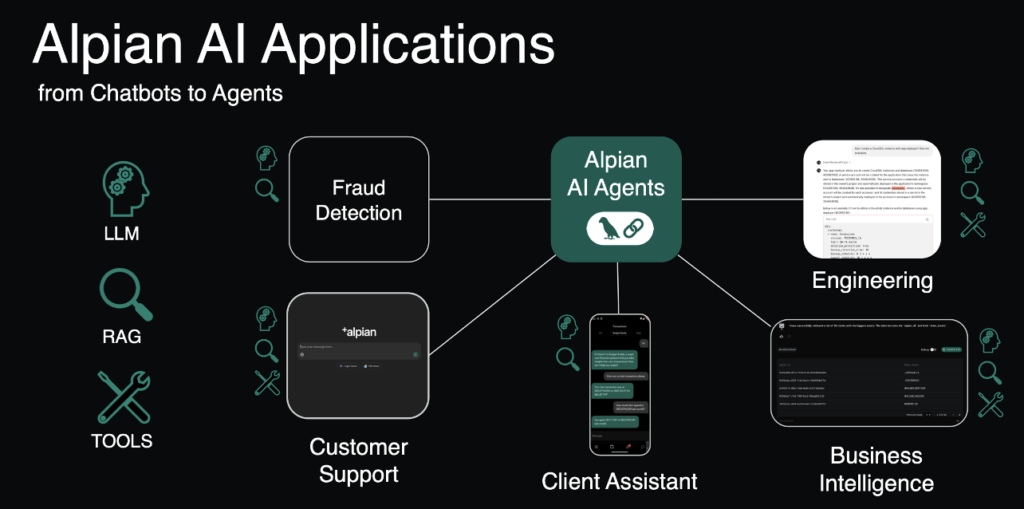

Alpian uses AI across multiple areas—client interaction, operational efficiency, and engineering optimization. But AI without real-time context is limited and error-prone.

Here, data streaming plays a crucial role. Kafka events provide AI agents with the fresh context they need for relevant and accurate output.

Alpian’s AI stack includes:

- LLMs and Gemini models on Vertex AI

- RAG (Retrieval-Augmented Generation) for grounded reasoning

- Agentic AI that uses Kafka events to respond with context-aware decisions

- Embedding and vector search for fast, intelligent retrieval of domain knowledge

- Real-time monitoring, evaluation, and prompt management

AI agents are not just chatbots—they operate with autonomy, using Kafka-based domain events to make decisions, trigger actions, or escalate when needed.

Compliance is built in: explainability, user feedback, runtime controls, and testing pipelines are part of Alpian’s AI governance framework.

Learnings from FinTech Alpian and the Future of Data Streaming, Agentic AI and RAG

Alpian sets a new standard for regulated FinTech. Its platform demonstrates how real-time infrastructure, domain-driven design, and embedded governance enable innovation without compromising control.

Key takeaways:

- Events and Data: Event-driven systems offer agility, resilience, and clean separation of concerns. Domain events serve as reliable building blocks for analytics and AI.

- RAG and Contextual AI: Accurate AI depends on real-time context. RAG with streaming provides this context—grounded in fresh, structured domain data.

- Governance and Controls: Encryption, access rights, and validation must be integrated into the development lifecycle. Field-level encryption (CSFLE) and schema enforcement are crucial.

- Streaming + AI: Kafka delivers the real-time signals AI needs to be effective. The freshness of context enables smarter, more trustworthy decisions.

Alpian offers a clear message: innovation and regulation are not opposites. With the right architecture, data strategy, and governance, it’s possible to deliver secure, real-time financial services that customers trust.

If you want to learn more about data streaming and any AI-related topics like GenAI, RAG, or Agentic AI with standard protocols such as MCP or A2A:

- Real-Time GenAI with RAG using Apache Kafka and Flink to Prevent Hallucinations

- Apache Kafka + Vector Database + LLM = Real-Time GenAI

- Real-Time Model Inference with Apache Kafka and Flink for Predictive AI and GenAI

- How Apache Kafka and Flink Power Event-Driven Agentic AI in Real Time

- Agentic AI with the Agent2Agent Protocol (A2A) and MCP using Apache Kafka as Event Broker

Join the data streaming community and stay informed about new blog posts by subscribing to my newsletter and follow me on LinkedIn or X (former Twitter) to stay in touch. And download my free book about data streaming use cases, including various examples in financial services and AI-related topics like fraud prevention and generative AI for customer service.